We are often asked “Can I Keep my house if I file Chapter 13 bankruptcy?” The ability to prevent a foreclosure and/or keep your house is one of the primary reasons to consider filing for Chapter 13 bankruptcy.

There are many areas of downtown Louisville and neighborhoods such as Old Louisville, West Louisville, Taylor Berry, and the areas surrounding Churchill Downs and the University of Louisville where a chapter 13 bankruptcy can help to protect your home while providing the opportunity to reorganize your debts in a way you can manage going forward.

My name is John Schmidt, and after more than 25 years of experience helping the people of Jefferson, Bullitt, Hardin, Spencer, Shelby and Oldham counties to file for bankruptcy I can tell you it is absolutely possible to keep your house while reorganizing debts in order to strengthen your financial position, get out of debt and avoid a foreclosure.

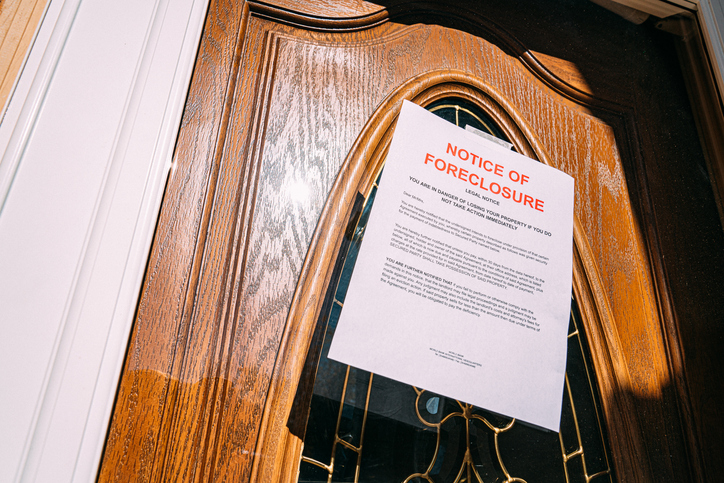

How can I keep my house if I file chapter 13 bankruptcy? Filing bankruptcy chapter 13 puts an immediate stop to all collections associated with your debts, including the mortgage. If your house is near or in the process of foreclosure, the process will be suspended while we seek approval of your chapter 13 bankruptcy repayment plan.

Our clients are so relieved once we get the initial chapter 13 bankruptcy notice filed. The calls, emails, texts, letters and harassment immediately stop. Creditors must obey the law and provide the time and space for you to work with us to develop a plan of action and submit it to the bankruptcy Court for review and ultimate approval.

The first step is a set of calculations to determine the exemptions that are available to you under Kentucky and federal bankruptcy law as well as the amount of equity you have in your home. Can you protect all of the equity you have in your home through existing exemptions? In order to seek approval of your reorganization plan under a Chapter 13 bankruptcy, we will need to prove you have enough money coming in to keep your mortgage current going forward while repaying the amount you are behind on your mortgage over time.

If the value of your first mortgage exceeds the present value of your home it might be possible to get rid of other liens on the property such as a second mortgage. This is why it is so important to work with an experienced Shepherdsville bankruptcy attorney from the Law Offices of John Schmidt & Associates, PLLC. There are many financial strategies when filing for chapter 13 to help reduce unsecured debt (such as credit cards) while protecting assets that are important to you such as your home and car(s).

What are your existing secured and unsecured debts? What assets (if any) do you own free and clear? We work with you to establish a comprehensive picture of where you presently stand from the perspective of assets and debts. We work through several points of analysis and calculations to determine the best options for structuring a proposed repayment plan over a period of three to five years.

Basically, once we’ve worked together to build a plan you can work with we submit it to the bankruptcy Court or trustee for review and approval. Creditors may object or the trustee may have concerns with a detail or two. In some cases we simply need to make some proposed revisions to get the plan approved and moving forward.

Are you wondering “How can I Keep my house if I file Chapter 13 bankruptcy?” in Shepherdsville, Mount Washington, Shelbyville, Taylorsville, Radcliff, Elizabethtown, Jeffersontown or Louisville, Kentucky?

The process begins with a conversation. I invite you to contact us via e-mail, schedule an appointment or call us today at (502) 509-1490 to get a free evaluation and consultation and more information about how the process works.